Car servicing made simple

Tips to keep your car running smoothly

The calendar may have ticked over to March, but summer is still here, making it the perfect time to give your car some attention. To ensure your car stays cool, safe, and reliable into the autumn months, a little car maintenance goes a long way.

We’ve recently partnered with My Auto Shop – a one-stop online booking service that can handle all your car maintenance needs. From servicing and repairs to tyre replacement and pre-purchase inspections, My Auto Shop eliminates the hassle of car maintenance. Their team comprises of reputable mechanics and car servicing providers who can conveniently come to your home or workplace.

In the meantime, here are some simple checks you can perform until it’s time to call in the experts:

Check your air conditioning

Why it matters: There’s nothing worse than being stuck in traffic with no air con on a hot day! A fully functioning air con system is a must have for comfort.

What to do:

- Make sure your air con is blowing cold air.

- If it’s not, or if you hear unusual noises, it might be time for a system check-up.

- Keep the vents clean for better airflow.

If you’re noticing poor cooling performance, My Auto Shop can help recharge your air con and check for leaks or damaged components.

Inspect your tyres

Why it matters: Hot roads can cause tyre pressure to rise, which may lead to punctures or reduced tread life. Properly inflated tyres also improve fuel efficiency and safety.

What to do:

- Check your car’s tyre pressure regularly, especially before long trips.

- Inspect the tread depth and look for signs of wear or damage.

- Get your tyres rotated to ensure even wear

Warm temperatures can cause tyres to age faster. Schedule a tyre check-up to make sure yours are safe for the rest of the season.

Top up fluids

Why it matters: Your car’s engine and other components work harder when it’s hot, so it’s important to have sufficient fluid levels to avoid overheating.

What to do:

- Check your engine oil, coolant, brake fluid, and power steering fluid levels.

- Consider getting an oil change if you’re due or if it’s been a while.

- Have your coolant flushed and replaced to prevent your engine from overheating.

For some cars, warning lights on the dashboard can indicate low fluid levels however, where they are hidden under the bonnet can make it difficult to check yourself. Book your car in for a service with My Auto Shop for professional assistance and added peace of mind.

Inspect the battery

Why it matters: Hot temperatures can put extra stress on your battery, potentially leading to failures, especially if it’s older.

What to do:

- Look for signs of corrosion around the battery terminals.

- Ensure the battery is securely mounted to prevent vibrations.

- If you can, test the battery charge if it’s more than 3 years old.

If your car struggles to start or if your battery is over three years old, it could be time for a check-up or replacement.

Check your brakes

Why it matters: Road trips and longer drives over summer puts extra strain on your brakes. Ensuring your brakes are in top condition is crucial for safety.

What to do:

- Listen for squeaking or grinding sounds when you apply the brakes.

- Check the brake pads for wear.

- Have your brake fluid checked.

If you’ve noticed any unusual sounds or performance issues, it might be time for a professional inspection.

Change your windscreen wiper blades

Why it matters: Rain and even dust from road works can catch you off guard. Good wiper blades are essential for clear visibility.

What to do:

- Inspect your wiper blades for cracks or fraying.

- Replace them if they’re streaking or not clearing the windscreen effectively.

Ready to hit the road?

Car maintenance doesn’t have to be stressful. By following these simple tips, you’ll ensure your car runs smoothly and safely all season long. If you prefer to leave the work to the professionals, don’t hesitate to schedule a service or appointment with My Auto Shop. Plus, for the month of March 2025 receive 10% off any My Auto Shop product or service when you quote promocode: OXFORD10.

Renewing your car insurance with Quashed

Renewing your car insurance – How Quashed makes it easy

Renewing your car insurance can be stressful, but thanks to Quashed.co.nz, it doesn’t have to be. Whether you’re a seasoned driver or new to the road, Quashed streamlines the entire process, so you can find the best car insurance coverage while saving money. Oxford Finance proudly supports this service, and we’re excited to share it with our customers.

Types of car insurance in NZ

Insurance is a necessary step for every car owner when you arrange vehicle finance. When renewing or looking for car insurance, it’s important to understand the types of cover available. There are three major types of vehicle insurance:

- Third party – This is the most basic form of insurance and covers damage you cause to someone else’s vehicle or property. However, it does not cover any damage to your vehicle.

- Third party, fire and theft – This type of insurance covers damage to other people’s property and protects your car in the event of fire or theft, giving you extra peace of mind.

- Comprehensive insurance – This is the most extensive form of coverage, and if you get a car loan, you’ll need to purchase this level of insurance. It covers third-party damage and protects your vehicle against accidental loss or damage, including natural disasters, vandalism, or accidents.

Choosing the right type of car insurance depends on factors like your vehicle’s value, your budget, and how much risk you want to cover. Quashed helps you compare these options to find the policy that fits your needs and budget.

Why should you regularly review your car insurance?

When renewing your car insurance, it’s a good idea to begin by reviewing the policy you are currently under. Key reasons to review include:

- Cost savings – Car insurance premiums can vary greatly depending on your circumstances, location, and the current market. For a better understanding of average premium costs across New Zealand, look at Quashed’s guide on the average cost of car, house, and content insurance. This resource insights into how these costs compare nationally, which can help you make an informed renewal decision.

- Ensuring optimal coverage – Your life’s circumstances change over time. Whether you add new drivers to your policy or simply change jobs, your insurance needs can shift. It’s important to review your insurance to match your current needs.

- Avoiding price increases – Some insurance companies may raise their prices annually. Reviewing and comparing your policy ensures you are not caught off guard by a price hike and are still getting cost-effective coverage.

- Access to new benefits – Insurance providers sometimes update their policies, introducing new features or benefits. By reviewing your policy, you can take advantage of these enhancements.

How does Quashed help you find the best car insurance?

Quashed is an innovative insurance management platform that simplifies comparing, shopping, and renewing insurance. Here’s how Quashed helps you find the best car insurance policy:

- Comparison tool – Quashed allows you to compare your current car insurance policy’s premiums and features against other available options. This ensures you’re getting the best value for your money.

- Comprehensive analysis – The platform analyses various factors, such as coverage limits and add-ons, helping you make informed decisions that suit your specific needs.

- Annual shopping assistance – Quashed helps you shop for car insurance every year, making sure you always have access to comprehensive rates and the best coverage options available in the market.

Renewing your insurance with Quashed

Before you begin, you’ll need to have your existing car insurance policies on hand and ready to upload. Once you’ve done that, it’s a straightforward process.

- Policy tracking – Quashed stores all your insurance policies in one place, making it easy to track renewal dates and stay on top of your coverage.

- Automatic comparison – As your renewal date approaches, Quashed automatically compares your current policy to other available options in the market, helping you find the best deal.

- Renewal recommendations – Quashed provides personalised renewal recommendations, suggesting whether to stay with your current provider or switch to a more competitive option.

- Seamless renewal – Once you’ve chosen your new policy, you can renew it directly through the Quashed platform, making the entire process seamless and hassle-free.

Get started with Quashed

Renewing your car insurance doesn’t have to be a daunting task. With Quashed you can compare, shop, and renew your car insurance easily, all while ensuring you have the right coverage at the best price. By regularly reviewing your policy and using its comprehensive tools, you can save money and have peace of mind knowing you’re protected on the road. Get started with Quashed.co.nz today for free.

Secured vs unsecured personal loans

We explain the difference these two types of personal loans

Oxford Finance have recently launched a new loan product offering – Unsecured Personal Loans. A convenient and flexible loan solution with a fast online application and approval process.

So, what is an unsecured loan? How does it differ from a secured loan? And is it the right fit for you?

In this article we outline the two loan types, each with its own set of characteristics and considerations. Read on to learn the differences between secured vs unsecured personal loans and make an informed decision on the best loan type for you and your finances.

Secured Personal Loans

Collateral required – Secured personal loans require backing by an asset as collateral against the loan. For Oxford Finance this generally would have the backing of a car or a property.

Lower interest rates – Because the lender has the security of your collateral, secured loans typically come with lower interest rates compared to unsecured loans. This is because the risk to the lender is lower.

Higher borrowing limits – Secured loans often allow for higher borrowing limits as the collateral provides assurance to the lender.

Longer repayment terms – These loans may have longer repayment periods. This can make monthly payments more manageable but may result in higher total interest payments over time.

Risk to collateral – If you default on the loan, you risk losing the asset you used as collateral.

Unsecured Personal Loans

No collateral required – Unsecured personal loans do not require any collateral. There is a lot of trust with this type of loan, with approval being based primarily on your creditworthiness and ability to repay the loan.

Higher interest rates – Since the loan is collateral-free, lenders perceive unsecured loans as riskier. Therefore, interest rates tend to be higher compared to secured loans.

Lower borrowing limits – Typically, the amount you can borrow with an unsecured loan is lower than with a secured loan because the lender has no asset to recover in case of default.

Shorter repayment terms – Repayment terms for unsecured loans are usually shorter than those for secured loans, which can mean higher monthly payments but lower overall interest costs.

Credit requirements – Lenders may have stricter credit score and income requirements for unsecured loans because they rely more heavily on your financial stability and credit history.

Secured vs unsecured – which loan should you choose?

Consideration 1: Loan amounts

Consider how much you need to borrow – a higher loan limit is likely offered by a secured loan vs an unsecured loan.

Consideration 2: Interest rates

Compare the total cost of borrowing (including interest rates and fees) for both types of loans.

Check out our easy to use Secured Personal Loan calculator, or Unsecured Personal Loan Calculator to see what your repayments could look like.

Consideration 3: Credit history

Your credit score and financial history will significantly influence your eligibility, and the term offered by both secured and unsecured loans.

Consideration 4: Convenience

If you are in a situation where you want to borrow a smaller amount of money for things such as a holiday, education, or to cover unexpected expenses without the need for collateral, then an unsecured personal loan could be the right fit for you.

Talk to the experts about your loan requirements

If you’re thinking about unsecured personal finance, or have any questions around applying for finance, get in touch with our friendly team at Oxford Finance, we’re here to help.

Before choosing any type of loan, it’s important that you carefully assess your financial situation, your budget and needs. Talk to a financial advisor or check out useful websites such as MoneyTalks to ensure you’re making an informed decision.

If you have a loan with Oxford Finance and are experiencing an unforeseen change in your financial situation, don’t leave it too late to contact us, or, find out more about hardship options on our website.

Get in touch with us about your loan queries today.

Top power savings tips

We share some great ways to save on your power bill

We recently an a Facebook competition asking people to tell us their top power savings tips to be in to win a $500 cash prize. We received a great response with over 400 entries and lots of useful power saving ideas.

And while many ideas seem obvious, it’s a timely reminder that when you put these habits in place, you cannot only save power, but a little extra money too.

Here is a list of the top 20 tips we’d love to share with you.

Top 20 power savings tips

- Only run your dishwasher, washing machine or dryer when you have a full load.

- Quicker showers for the kids by playing one of their favourite songs on the speaker as their timer. Helps save power and water.

- Close all your blinds or curtains at sunset before the temperature drops to retain heat.

- Air out your house daily, and if possible dry windows if there is condensation – A dry house is a lot easier to keep warm.

- Not all heaters have thermostats, so get a timer or smart plug for your heaters. A smart plug can also set heaters to switch on and off depending on the temperature of the room.

- After using the oven for dinner, open the door and leave it open for a while to let the warmth out.

- Check all your appliances – are they on standby mode (switched on at the wall)? Do they need to be on standby mode, or can they be switched off when not in use? Every little bit helps.

- Energy efficient lighting. Use LED bulbs instead of incandescent ones. LEDs use less energy and produce less heat.

- Clean your heat pump filters at least once every three months.

- If you’re cooking on the stove top, cover your pots with lids. It reduces cooking time and energy use.

- Go outside and do some exercise. You’ll soon warm up and feel great at the same time.

- Run your ceiling fan in reverse at a low speed. It will circulate warm air that rises to the ceiling and then back down into the living area.

- I switched to a new power plan that has free power from 9pm – midnight and my bills are lower compared to last winter.

- Keep the heat pump on 21 degrees and switch the fan to auto.

- Close doors to rooms you are not using.

- Wash your clothes on a cold-water cycle. Adds up to be a lot in savings, especially when you have a large family.

- Insulate your water heater with a water heater blanket.

- Plant windbreaks. Trees and shrubs can block cold winds.

- Cook with appliances such as a slow cooker, air fryer or bench-top oven instead of using your oven all the time.

- Simple DIY around the home can add up to noticeable savings in energy usage. Things like door strips, window seals, or a cheap double glazing film can help.

For more power saving tips and information, check out these useful resources:

If you’re thinking about getting a loan, or have any questions around applying for a loan, get in touch with our friendly team, we’re here to help. Alternatively, if you have a loan with Oxford Finance and are experiencing an unforeseen change in your financial situation, don’t leave it too late to contact us, or, find out more about hardship options on our website.

How to choose the right car loan for your NZ SME

Do you need a new vehicle for your business? We'll tell you how.

Are you a small or medium enterprise (SME) business owner or sole trader looking to branch out and invest in a company vehicle? Securing the right SME car loan is an important consideration for any New Zealand business, impacting financial flexibility and operational efficiency. From understanding the repayment options to evaluating interest rates, we’ve highlighted the information you need to help you choose a small business car loan that aligns with your strategy and growth plans.

Understanding your business needs

Transportation requirements

When considering your SME’s transportation requirements, determine the purpose and necessity of the vehicle for your business operations – Whether it’s for deliveries, client meetings, or transportation of goods, it’s important to clarify the vehicle’s role. Next, consider the vehicle type and choose a vehicle that suits your business needs. Think about the size, capacity and features that are essential for your operations. E.g. An EV vehicle to reduce fuel costs may be best suited to a sales person driving daily in city traffic.

Budget and cash flow

When choosing the appropriate SME car loan, ensure you factor in the upfront costs, including any required deposits or associated fees, which can affect your liquidity. It’s important to make sure your monthly loan repayments are manageable and within your business’s budget.

Evaluate:

- Resale value – Consider the vehicle’s resale value. Some vehicles depreciate slower than others, impacting long-term costs

- Maintenance and repairs – Budget for regular maintenance (fuel, servicing and insurance), and potential repairs to avoid operational disruptions.

Thoroughly assessing these elements will help maintain a healthy cash flow, allowing your business to continue operating efficiently while managing new financial commitments from the vehicle loan.

Key Considerations for SMEs

Loan terms

Consider the length of the loan term. Shorter terms may have higher monthly payments but lower overall interest costs, while longer terms have lower monthly payments but higher total interest.

The ability to repay the loan early or refinance based on changing financial circumstances can offer significant advantages, including potential interest savings and better cash flow management.

Eligibility requirements and documentation

During a car loan application, we require businesses to provide detailed financial statements and a review of the company’s credit history to assess their risk and financial health:

- Business plan – A clear business plan explaining how the vehicle will enhance operations can support your loan application

- Proof of income – Provide proof of your business income, such as tax returns, bank statements, and invoices

- Legal documents – Have your business registration (NZ business number if you are a sole trader), licenses, and other legal documentation ready for review.

Collateral or security (in the form of the vehicle or other business assets) may be needed in addition to secure the loan.

Future planning and tax implications

When choosing the right vehicle for your business it’s important to look ahead, evaluate and consider the following:

- Depreciation – Factor in vehicle depreciation (second-hand vehicles are subject to depreciation too), and its impact on your business going forward. For detailed information and the latest guidelines, visit the Inland Revenue Department (IRD) website on depreciation here.

- Upgrade and maintenance – Plan for the vehicle’s long-term maintenance and eventual upgrade or replacement.

- Deductions – Understand the tax implications, including potential deductions for interest payments and depreciation.

- GST – Consider the impact of GST on the purchase and ongoing running costs of the vehicle.

Work with a lender you can trust

Oxford Finance provide secured business vehicle loans with varying interest rates depending on the loan type. Loan terms can range from 1 to 5 years, with flexibility to match the expected vehicle lifespan. We offer a personalised services and work closely with SMEs to understand their needs.

Contact us or apply online today to find the right business vehicle loan for you and your business.

Affordable ways to have fun on a tight budget

You can still have fun without spending too much money

When expenses are increasing, sticking to a budget can be a little overwhelming. It can easily feel like there’s little or no money left over for any sort of fun after all the bills and essentials have been paid. However, having fun on a budget is definitely possible. It just requires a bit more creativity and planning ahead. Plus, it’s a lot easier to stick to your budget if you allow for a well-deserved break every now and then.

Here are some ideas:

Free events

Keep an eye out for free events in your community. Check out your local council website and see what’s on offer. It could be concerts, art exhibitions, or festivals depending on the season. Many cities and town have regular free events that offer entertainment without a cost.

Host a potluck dinner

Invite friends or family over for a potluck dinner where everyone brings a dish to share. It’s a great way to enjoy good food and company without spending a lot of money.

Watch movies the cheap way

Find out what day of the week your local cinema offers a discount day, or special movie deal and go then. Or, stay home and watch free to air streaming on TVNZ+ or ThreeNow. You’ll be surprised at the variety of free tv shows and movies available.

Picnics in the park or at the beach

Pack some sandwiches, snacks, and drinks, and head to a local park or beach for a picnic. Enjoy the outdoors, play cricket, throw a frisbee, or just sit back and relax.

Search for specials

Find mid-week meal deals at your local restaurant or pub. Check out websites like GrabOne. You can find discounts on things like activities, restaurants, accommodation and items from participating stores throughout the country.

Enter competitions and giveaways

Someone has to win and it could be you!

Spend time outside

Explore nature and head out bike riding or bush walking in a nearby regional park. It’s the perfect way to get in some exercise too.

Visit your local library

Aside from the books and eBooks you can borrow, libraries often run free events, workshops, talks, exhibitions, as well as activities for the kids in school holidays.

Games night

Invite friends over for a games night. Dust off your board games, deck of cards, or have everyone bring their game of choice. It’s a fun way to spend time together without spending a lot of money.

Explore free online resources

There are lots of free online resources to learn and stretch your knowledge. You can watch educational videos, listen to podcasts, or take free courses on topics that interest you.

With a little creativity and resourcefulness, you can still have plenty of fun without spending a lot of money.

If you have a loan with Oxford Finance and are experiencing an unforeseen change in your financial situation, don’t leave it too late to contact us or call 0800 88 44 66.

Fraud awareness

Tips to recognise and avoid identity fraud

Having your identity stolen can be an extremely distressing and financially damaging experience. Unfortunately, identity fraud occurs more often than you may think. As we rely more and more on digital technology in our everyday lives, personal information is increasingly vulnerable to theft and misuse.

To help you recognise and avoid identity fraud we’ve put together some useful tips.

Secure your personal information

Keep your personal information such as your IRD number, and bank account information secure. Avoid carrying unnecessary identification documents in your wallet or handbag.

Be wary of sharing personal information

Be cautious when sharing personal information online, over the phone, or via email. Ensure you’re dealing with reputable companies and only provide personal information when necessary, and to trusted sources.

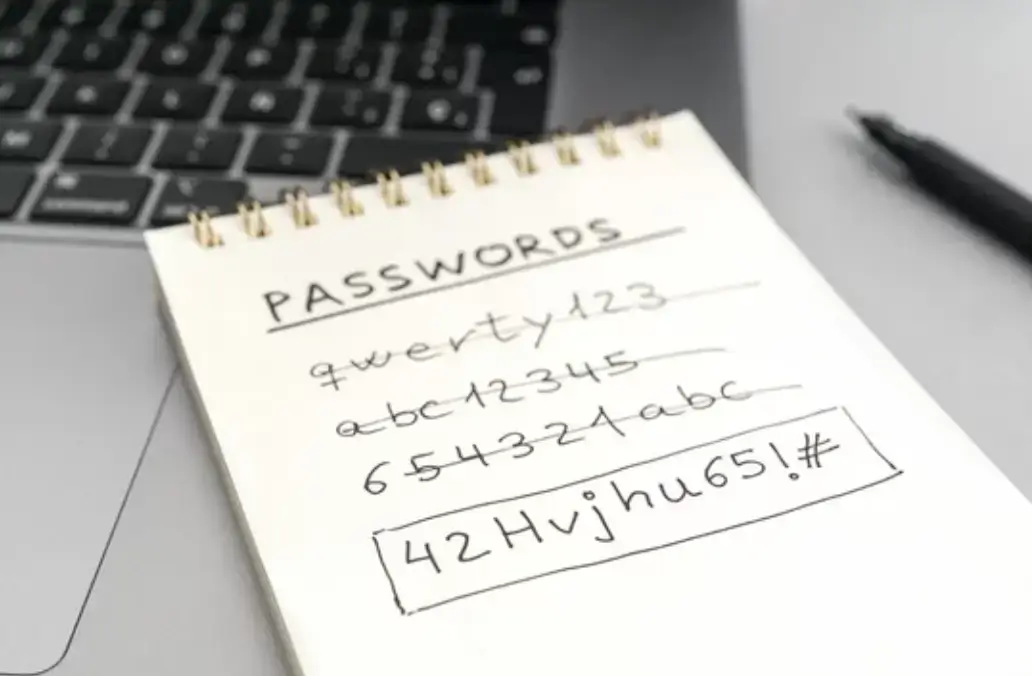

Use strong passwords

Create strong, unique passwords for your online accounts and change them regularly. With so many logins and passwords to remember, from subscription services to online banking, we understand it’s tempting to use the same one again and again. However, please avoid using easily guessable or obvious passwords like your birthdate, or the word ‘password’ – you’ll be setting yourself up as an easy fraud target.

Disposal of personal documents

Make sure you shred any old bank statements, power bills, or any document that has your name and address on it, and never put these documents in a public rubbish bin. Think about getting your statements sent to you online instead.

Getting rid of your old laptop or computer?

Make sure you remove all your personal information before you dispose of them.

Enable two-factor authentication

Whenever possible, enable this two-step login process to your online accounts. It adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

Check your bank accounts regularly

Regularly monitor your bank and credit card statements for unauthorised transactions. If you notice anything unusual contact your bank immediately.

Be cautious of unexpected events

Be sceptical of unsolicited emails, phone calls or text messages requesting personal information or financial details, and never click on any links. Legitimate companies typically won’t ask for sensitive information via these methods.

Keep your software up to date

Ensure your devices, including laptops, computers, and phones have up-to-date security software and operating systems to protect against the latest viruses and other cyber threats.

Review your credit report

It’s a good idea to regularly check your credit report and look out for any unusual or suspicious activity.

Use secure Wi-Fi networks

Try to avoid accessing your bank account or making financial transactions on public Wi-Fi networks, as these can be susceptible to hackers.

Keep yourself informed

Stay informed about identity theft scams and tactics used by criminals. Check the news and talk to friends and family. Being aware of potential threats can help you recognise and avoid them. Check out Scam Watch, a NZ government website for useful information and tips.

Should the unthinkable happen, here are the steps to take if you suspect your identity has been stolen:

- If your drivers licence has been stolen, contact and alert the New Zealand Transport Agency (NZTA).

- If your passport has been stolen, contact and alert Internal Affairs.

- File a 105 police report. The police report should highlight what happened, and to the best of your knowledge, who committed the fraud.

- In all cases if you think someone has or is using your details, contact all local NZ credit agencies (Centrix, Equifax and Illion) to put a freeze on your profile. This is to mitigate any use of your credit information if an unauthorised person applies for credit using your personal details.

Has something else been stolen? Check out the New Zealand Department of Internal Affairs (DIA) website for a full list of what you need to do for lost and stolen personal documents.

Don’t let yourself become and easy target! By taking proactive steps to safeguard your personal information and staying vigilant against potential threats, you can reduce the risk of falling victim to identity theft.

Car loan affordability tips

What you need to know before you apply.

Before applying for a loan, it makes sense to assess your financial situation to find out how much money you can afford to borrow.

Here are some tips we’ve put together to help:

Know your budget

Before considering a loan amount it’s a good idea to review your monthly budget. It will help you understand how much you can comfortably allocate towards regular car loan payments without straining your finances. Remember to account for other expenses like rent or mortgage, groceries, insurance, other loan payments including buy now pay later, and utility bills such as power and broadband.

Calculate total costs

Think about and consider all the costs associated with owning a car, not just the fortnightly or monthly loan payments. This includes things like insurance, fuel, maintenance (including warrant of fitness and registration), and potential repairs. Factor these into your budget to ensure you can afford the total cost of car ownership.

Find out about loan terms

Understand the loan terms, such as the interest rates, loan duration, and any additional fees. To give you an idea of what your car loan payments might look like, check out our handy Car Loan Calculator. You can easily adjust the loan amount, term, and frequency to see your estimated loan repayment amount.

Evaluate your credit score

Your credit score plays a significate role in determining the interest rate you’ll receive on a car loan. Firstly, find out what your credit score is. To get a free copy of your personal credit report provided by Centrix Credit Bureau, visit their website here. Check your credit report for any errors and work on improving your score if it’s not in the best shape. A higher credit score can result in lower interest rates and better loan terms.

Save for a deposit

Saving for a deposit can help reduce the loan amount and could lower your repayments. Aim for a substantial deposit to demonstrate financial responsibility and potentially improve your loan terms.

Consider a pre-approval

Getting pre-approved for a car loan can give you a better understanding of how much you can borrow and the interest rate you qualify for. Pre-approval can also streamline the car buying process and give you negotiating power when you’ve found the car you want.

Be realistic

Be realistic about the type of car you can afford based on your budget and financial situation. Avoid stretching yourself too thin to buy a more expensive vehicle than you can comfortably afford. Look at your circumstances and how they may change over the next 12 months. Factor this into your decision making.

Understand

Ensure that you fully understand the loan and the obligations that you are entering into. Do not be afraid to ask someone you know and trust for assistance, or seek advice from an independent body that deals with finances.

By carefully evaluating your finances and considering these tips, you can determine a car loan amount that fits within your budget without compromising your financial stability.

Know that you are in good hands with us

Oxford Finance is a responsible lender, regulated by the Credit Contracts and Consumer Finance Act (CCCFA). We are a member of the Financial Services Federation and follow their principles on responsible lending and borrowing. Our experienced team of lenders are available to assist and answer any questions you have about applying for a loan – Get in touch with us today, customerservice@oxf.co.nz, www.oxfordfinance.co.nz.

Summer road trip car games

Car games to entertain the whole family

Summer holidays are almost upon us – Think melting ice-cream, hot sand, and large packs of pre-cooked sausages for the bbq. Whether you’re off to spend a few weeks at the bach, or a day trip to the beach, the long car journey with bored kids in the back can be a daunting prospect…but, it doesn’t have to be!

To avoid the endless variations of “Are we there yet”, try some of these fun car games to make the drive more enjoyable, and before you know it, you’ll have reached your destination.

Beehives game

If you’re out in the countryside look out for those colourful beehive boxes. If you spot one shout “beehives”. The person who spots the most by the time you arrive at your destination wins!

Twenty questions

One person secretly thinks of a person, place, or thing. The other players then take turns asking yes-or-no questions, such as “Can it fly?” or “Does it grow in the ground?” A round ends either when a player uses one of their questions to correctly guess the answer, or when all of the players have asked 20 questions and the answer is revealed. Each player gets at least one turning being “it.”

The supermarket game

Decide on your first player and ask them to think of an item you can buy at the supermarket. Everyone else takes turns guessing what it might be by asking a question. For example, “Is it frozen?”, or “Is it packaged in a box”. The first person to correctly guess the item wins and it’s their turn to think of something.

In my suitcase memory game

The first person starts by saying ‘I’m going on holiday and I packed …’ finish the sentence with any item that begins with the letter ‘a’. The next player repeats the sentence said by the first player and adds in an item to the list beginning with the letter ‘b’. Keep going and see how many letters you can get through before someone forgets.

Question time

A simple game to create distraction for the younger ones by asking them questions. Things like: “What are three things you want to do this summer”, “What is the most adventurous thing you’ve ever eaten?”, “What’s your favourite movie or cartoon character”.

The theme song game

One person hums a tune to a favourite tv show or movie, and everyone else tries to name the title as fast as possible. Then, the first person to guess correctly hums the next song and starts the game again.

Tell us a story

Get creative and invent a family fairy tale. The first person starts with “Once upon a time” and offers a complete sentence, then the second person adds to the story with their sentence. Take turns adding sentences until the story reaches a conclusion. Tip: You may want to set a time limit, say 15 minutes to tell the story, and for good measure, record it on your phone so you can laugh about it later.

Two truths and a lie

One person tells everyone else two things that are true and one thing that’s a lie. Everyone else in the car tries to guess which is the lie. The winner begins the game again with their two truths and a lie.

Fortunately, Unfortunately

This last game is a test of the imagination and can get quite silly very quickly. The first person starts a statement with “Fortunately” and the next person follows it up with a statement that relates to the first one but starts with “Unfortunately”. Keep going, alternating between fortunately and unfortunately. For example: “Fortunately, I packed lots of food for this holiday”, “Unfortunately, it just flew out the broken back window”. “Fortunately, I’ve patched up the window by taping up your beach towel”. Unfortunately, the towel just caught on fire…

Whatever game you choose, distraction and laughter are the ultimate goals. And, wherever you’re off to this summer, we wish you a safe journey, a very Merry Christmas and a Happy New Year.

Budgeting

Need help budgeting for Christmas and beyond?

We all know that the lead up to Christmas can be financially stressful. Juggling expectations from kids between what they want and what you can afford, to who’s going to buy the turkey or the ham for Christmas lunch.

If you’re look for help to organise your budget for Christmas and beyond, but don’t know where to start, you’ve come to the right place. Kiwis have access to some great budgeting advice and assistance from a range of different sources, including government agencies, non-profit organisations, and financial experts. The key is to find the right one that works for you.

Here we’ve put together some options for you to consider looking into.

Citizens Advice Bureau (CAB)

CAB offers free budgeting advice to New Zealand residents. They can provide you with information and resources to help you manage your finances effectively. Check out their website to find your nearest CAB office.

Sorted is New Zealand’s free (government funded) independent online guide that offers tools, calculators, and resources to help you create and manage your budget. It also provides information on a range of financial topics, such as savings, investing and getting out of debt.

MoneyTalks is a free financial helpline that provides confidential budgeting advice and information. You can reach them by calling 0800 345 123 or visiting their website.

Local Community Organisations

Many local community organisations and social service agencies offer budgeting advice and support for individuals and families in need. Check with your local council or community Facebook page for recommendations.

Financial Advisers

You may want to consider talking to a qualified financial advisor or planner for personalised budgeting advice. They can help you create a financial plan tailored to your specific goals and circumstances.

Work and Income New Zealand (WINZ)

If you are experiencing financial hardship, you may be eligible for assistance from WINZ. They can give you information about financial assistance and support, such as benefits and allowances.

Debt Consolidation Services

If you are struggling with debt, organisations like the New Zealand Federation of Family Budgeting Services can provide advice on debt management and consolidation. Additionally, talk to your loan provider, in some circumstances they may be able to vary or extend the terms of your loan. By extending the term of your loan it may be possible to reduce your regular repayments. However, the trade-off is that you will be paying off your loan for longer.

Financial Workshops and Seminars

Keep an eye out for financial workshops and seminars in your area. These events are often free and hosted by financial experts who can provide valuable budgeting insights.

Online Resources

In addition to the above linked websites, there are a number of online resources, blogs, and podcasts dedicated to personal finance and budgeting. Websites like Interest.co.nz and The Happy Saver offer lots of information and are a good place to start. Additionally, there are some great budgeting apps available that can track your spending and help you identify areas to focus on. Check out The Money Hub for a list of popular apps and find one that suits you.

Books and magazines

Head to your local bookshop or library, and look for books or magazines by New Zealand authors that focus on personal finance and budgeting.

Remember, budgeting is a personal journey, and the right source of advice for you will depend on your individual circumstances and needs. It’s also important to be cautious of anyone offering financial advice who is not qualified or reputable. Always verify the credentials of financial professionals and seek advice from reliable sources.

If you have a loan with Oxford Finance and are experiencing an unforeseen change in your financial situation, please don’t leave it too late to call us on 0800 88 44 66.